Seeking Value in Uncertainty

RiskLab at CSIRO’s Data61 provides the avenue for industry to engage directly with the extended network of technologists and academia to come up with innovative solutions and tools in quantitative risk and decisions-under uncertainty.

RiskLab at CSIRO’s Data61 is affiliated with the RiskLab global network as the RiskLab node in Australia. RiskLab at CSIRO’s Data61 is a multi-disciplinary centre for developing the latest solutions in using AI for revealing inter-dependency relationship among major economic variables, stochastic scenario generation and optimal decision under uncertainty.

RiskLab at CSIRO focuses on delivering innovative solutions and services in quantitative risk and optimal decisions under uncertainty for finance, insurance, mining, agriculture and cyber security.

Risklab seminars:

-

Title: Trends, Challenges and Opportunities in the Superannuation Industry

Presenter: Dr Oscar Tian, Senior Actuarial Manager, Insignia

Time/Date: 4pm-5pm, Wednesday, 22nd/October/2025

Location: Room 841, Level 8, 750 Collins St, Melbourne, Australia

-

Risklab Panel Discussion on AI on the 31/July/2025

Interactive Multivariate Clustering and Forecast of Economic Variables:

-

Single Variable Clustering and Future Predictions

-

Double Variable Clustering and Future Predictions

-

Three- to Five-Variable Clustering and Future Predictions

Further information:

-

Discovering Relationships Among Economic Variables using Machine Learning Techniques

-

Interactive Crop Yield Insurance Decisions under Uncertainty

Interactive Optimal Decisions in Superannuation

Please see our interactive simulation by clicking on the link below (using either Google Chrome or Firefox):

-

Stage 1 – SUPA Model

-

Stage 2 – SUPA Accumulation

-

Stage 3 – SUPA Decumulation

-

Stage 4 – Pension Multiplier

Further information:

-

Superannuation and Asset Management

- Interactive Optimal Decisions in Asset Allocation

- Dynamic Asset Allocation Strategy

Interactive Mining Valuation

-

Optimal Decisions for Resource Extraction under Uncertainty

-

An Analytic Platform for Decision-Making under Uncertainty

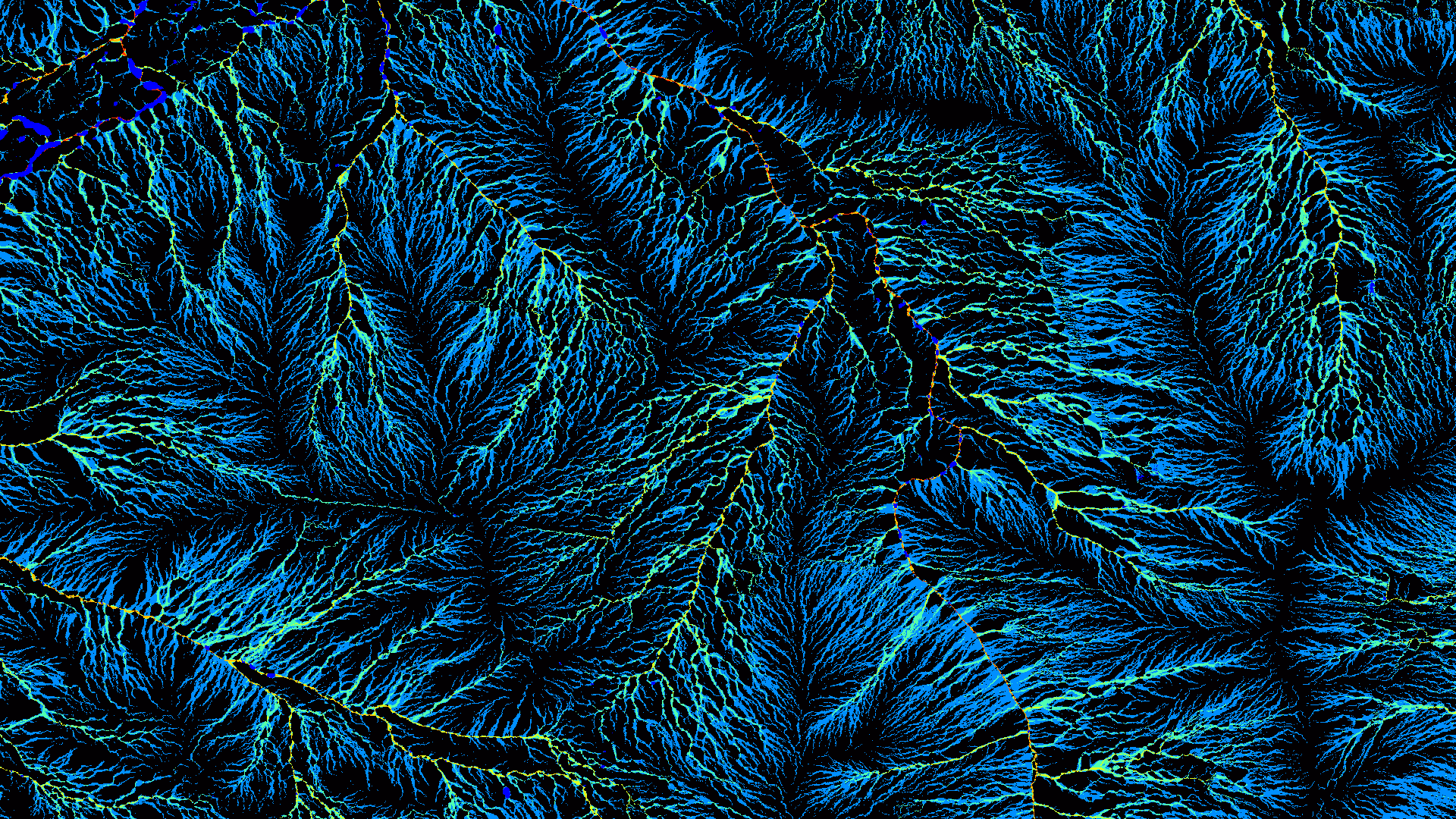

AI Algorithm to Reveal Complex Relationship

What are the relationships between Copper, Nickel, Coal, Crude Oil, Silver and Gold as well as ASX200 and Hang-Sen index? The following graph shows their inter-dependency: