Long‐term optimisation of multiple deposit mining operations

Valuing uncertainty through real options analysis

As the Australian mining industry transitions from a period of capital expansion to capital optimisation, there is a renewed focus on the need to extract the most value possible from Australia’s mineral resources. Real options analysis provides a tool to optimise projects and operating strategies in the

face of uncertainty surrounding future commodity prices, exchange rates and market conditions.

Real options analysis in the minerals industry

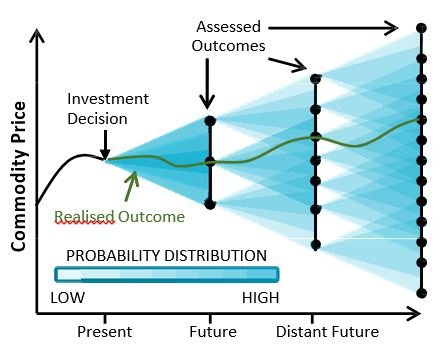

Real options analysis is a tool that can be used to address some of the limitations of traditional financial evaluation of projects. Fundamentally, it provides a method for determining the optimal decision to make at any point in time, given a large range of uncertainty over future financial and operating conditions (see Figure 1).

Real options analysis methodology has significantly evolved over time and is beginning to find new applications within the minerals and mining industry. Historically these applications have included:

- Assessing the sensitivity of financial analysis of mining projects to the underlying cost assumptions.

- Valuing operating flexibility to continue, expand or close operations.

- Determining the economic impacts of mining for different stakeholders, such as the operating company, government and the local community.

- Determining the optimal capacity of processing

- Determining the optimal cut‐off grades for exploiting an ore body.

- Comparing competing mine plans for individual deposits.

Applications for multiple mine‐site operations

A common situation in the minerals industry is for several mine sites to feed ore or concentrate to a central processing facility. Conventionally, each mine’s output would be blended to provide as constant a feed rate and grade as possible to the processing facility.

Our modelling has been shown that this may not be the optimal way to maximise the longer term profits of an operation. By varying the throughput and selectively blending the ore from each mine in response to projected market conditions, changing ore grades and remaining reserves available, it is possible to significantly improve profitability.

CSIRO’s Computational Informatics (CCI) Division has extended the Least Squares Monte Carlo method and developed the algorithms that can handle the complexity of these kind systems. Supported by the Minerals Down Under Flagship, Minerals Futures Theme this method has been applied to two nickel production case studies.

Figure 1: Real options analysis enables the systematic

evaluation of operating and investment decisions

Case studies for nickel production

Two preliminary case studies have been prepared to demonstrate the strengths of real options analysis. The development of this new methodology has enabled the quantitative comparison of different operational strategies including:

- A constant feed and grade strategy (conventional approach).

- Optimised blending to maximise profit for the current year

- Optimising blending to maximise long‐term profit, based upon a real options analysis

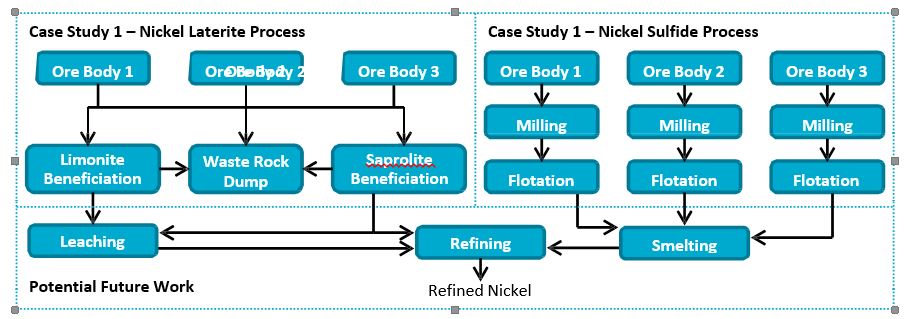

The systems considered are shown in Figure 2 (see reverse), with a brief description given below:

- The first case study considers the production of ore from three hypothetical nickel laterite mines being fed to a central processing facility. This system considers the layering of ore types within laterite deposits, and the different processing technologies for each ore type.

- The second case study considers three nickel sulfide mines and concentrators feeding a central smelter. The optimisation is compared with actual historical production results for these operations, over a five year period.

Figure 2: Process flow sheets for the two nickel case studies. Future work may extend these to include the full value chain.

Case Study Results

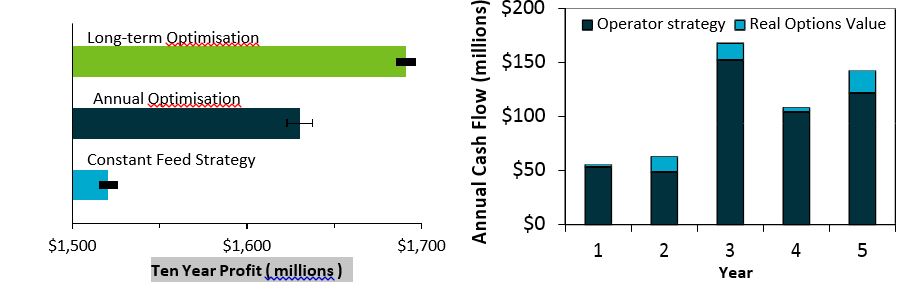

The outcomes of the two case studies are shown in Figure 3. For case study 1, the long‐term profit optimisation strategy significantly outperformed the constant feed strategy over a ten year period by 11%. The optimal strategy identified for case study 2 outperformed the actual production results obtained by the operating company over a five year period by 12%.

A potential area for future work is to extend the case studies to include the full nickel value chain. For laterite ores there are several different processing routes that can be applied to produce refined nickel. Scalable processes such as heap leaching provide in‐ built flexibility for production systems. Real options analysis has been shown to be particularly effective when applied to systems that can vary production in response to market conditions, and this is where real value can be obtained.

Sustaining Australia’s mineral industries

CSIRO is currently investigating the use of real options analysis to contribute to the long‐term sustainable development of Australia’s mineral industries. The methodology is being developed across various commodities and is being expanded to include water and energy consumption alongside the financial indicators. This will ensure that we get the highest return possible for the investment of Australia’s precious natural resources.

Real options analysis has a role to play in securing the future of Australian mineral operations. The examples provided for nickel illustrate the significant impact that this line of work could have for Australian mining operations more broadly. If the results of this study are applicable across Australia’s mining and minerals industry, it would represent up to $5 billion annually of untapped profits.

Figure 3: The ten year profits determined for case study 1 (left) and the annual cash flow for case study 2 (right).