Dairy production in Tanzania

Approximately 90% of milk in Tanzania is produced by cattle. The majority of this is produced in low input, low yielding systems and consumed by the producer’s household.

Industry snapshot:

- Tanzania has the 4th largest cattle herd in Africa – following Ethiopia, Sudan & Chad.

- 31 million cattle – kept for meat, milk, savings and draught power.

- Cattle population is concentrated in the lakes area, central Tanzania and the southern highlands.

- 99% of cattle are indigenous breeds. Improved dairy cattle are found primarily in the northern and southern highlands.

- Gross production value of cow milk in 2016 was US $196 million (85% total livestock value and 2% total agricultural value).

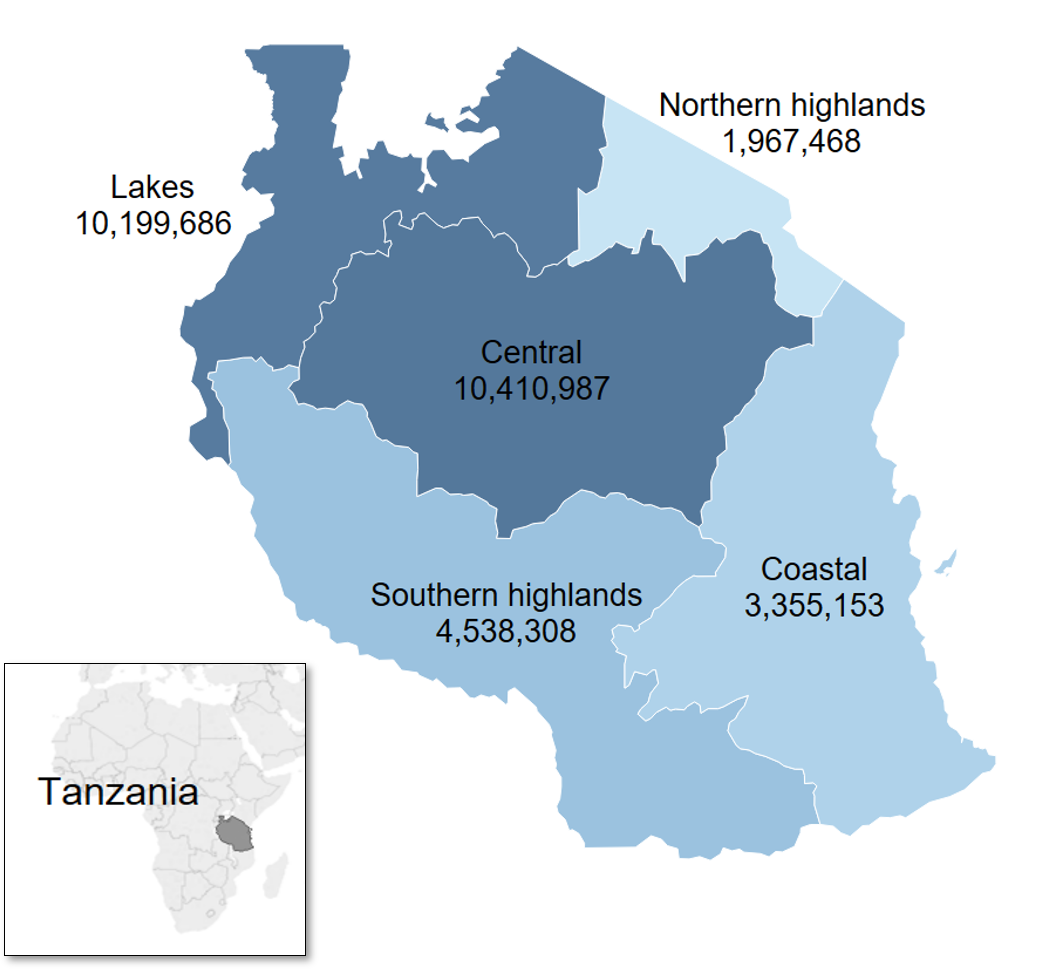

Tanzania cattle population

Most cattle in Tanzania are indigenous zebu breeds, which are used for meat, savings and draught power as well as milk production.

Cattle population (number of heads) by agricultural zone (Ministry of Agriculture 2018)

Tanzania cattle population by breed (Ministry of Agriculture 2018)

| Cattle breed | Number (heads) | % of total |

| Indigenous | 30,062,560 | 98.7 |

| Improved dairy | 239,227 | 0.8 |

| Improved beef | 169,820 | 0.6 |

Types of dairy production systems

Traditional meat-milk

- Large herds of local cattle in pastoral & agro-pastoral areas. Grazing of natural pastures, communal land and crop residues.

- Small amount of milk produced by large numbers of dual-purpose cattle.

- Milk is consumed by the household or sold through informal markets.

- Highly seasonal production.

Improved family & specialised dairy

- Ranges from smallholders with 2-3 cows to large, commercial-scale farms.

- Concentrated in highland and coastal areas.

- Intensive production systems based on cut and carry cultivated forage with minimal grazing. Feed is from crop residues, cultivated fodder and communal land.

- More likely to include improved and crossbred cattle breeds.

- Most milk is sold into formal value chains.

Value chains & market systems

- 97% of milk in Tanzania is consumed by the producer’s household or marketed locally through informal value chains, with no processing.

- Formal value chains supply processed milk and dairy products to consumers in urban and peri-urban markets.

- Dairy processing and collection centres are concentrated in the lake, northern coastal and highland regions.

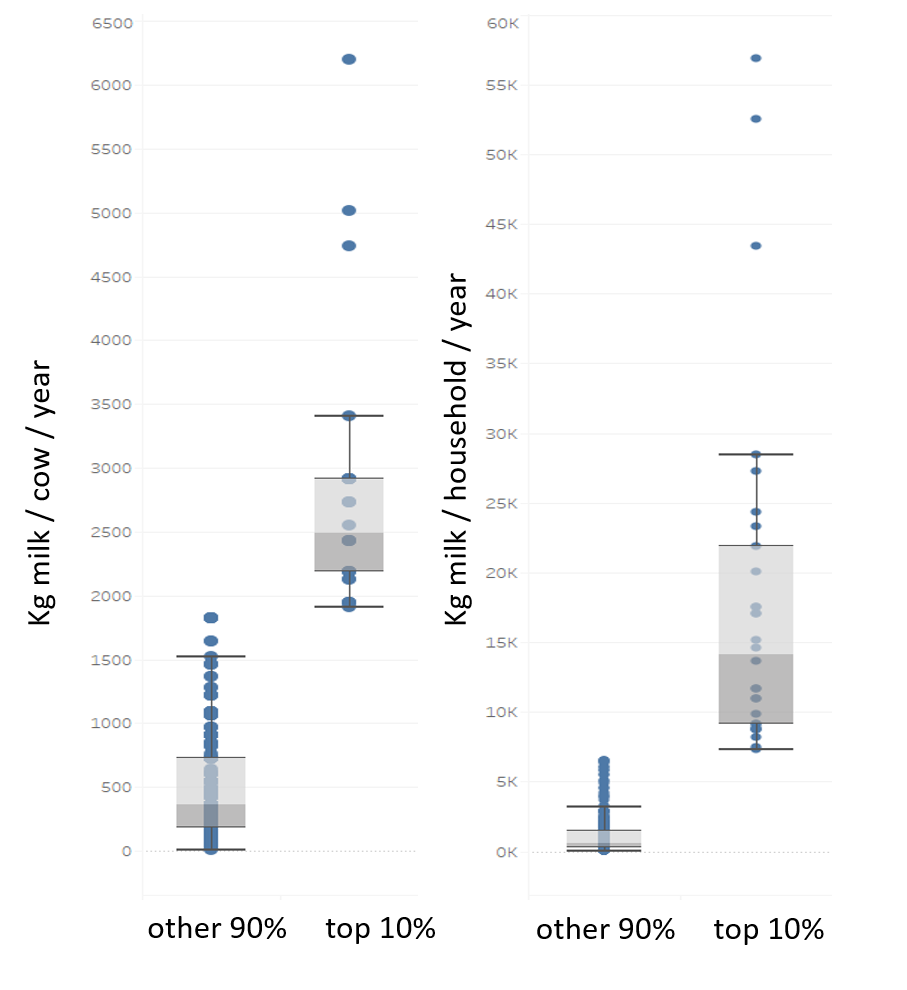

Milk yields

- Average national milk yields are around 2000 kg/cow/year.

- There are large variations in milk yields between farms and production systems. Yields are influenced by a range of factors including breed, nutrition, animal health and animal management.

Milk yields of the top 10% of cows (left) and households (right) compared to the other 90% (LSMS survey 2014-15)

Issues affecting milk production

Farm scale

- Seasonal feed shortages (natural grasses, crop residues)

- Decreased land area available for grazing

- Cost and variable quality of purchased concentrate feeds

- Genetic potential of cattle breeds currently used

- Inappropriate breeds for local conditions

- Cost and access to artificial insemination services

- Diseases that cause mortality or affect reproduction

Dairy value chains, markets & processing

- Current milk processors operate below their capacity

- Seasonality of milk production makes it hard for producers to engage in formal value chains

References:

- Ministry of Agriculture (2018) 2016/17 Annual Agriculture Sample Survey Crop & Livestock Report, Zanzibar

- FAOstat: www.fao.org/faostat

- LSMS Survey: https://microdata.worldbank.org/index.php/catalog/2862