Poultry production in Nigeria

The Nigerian poultry sector has expanded rapidly in recent years. Local production only meets 30% of the demand for chicken eggs and meat, thus there is huge scope for the industry to expand.

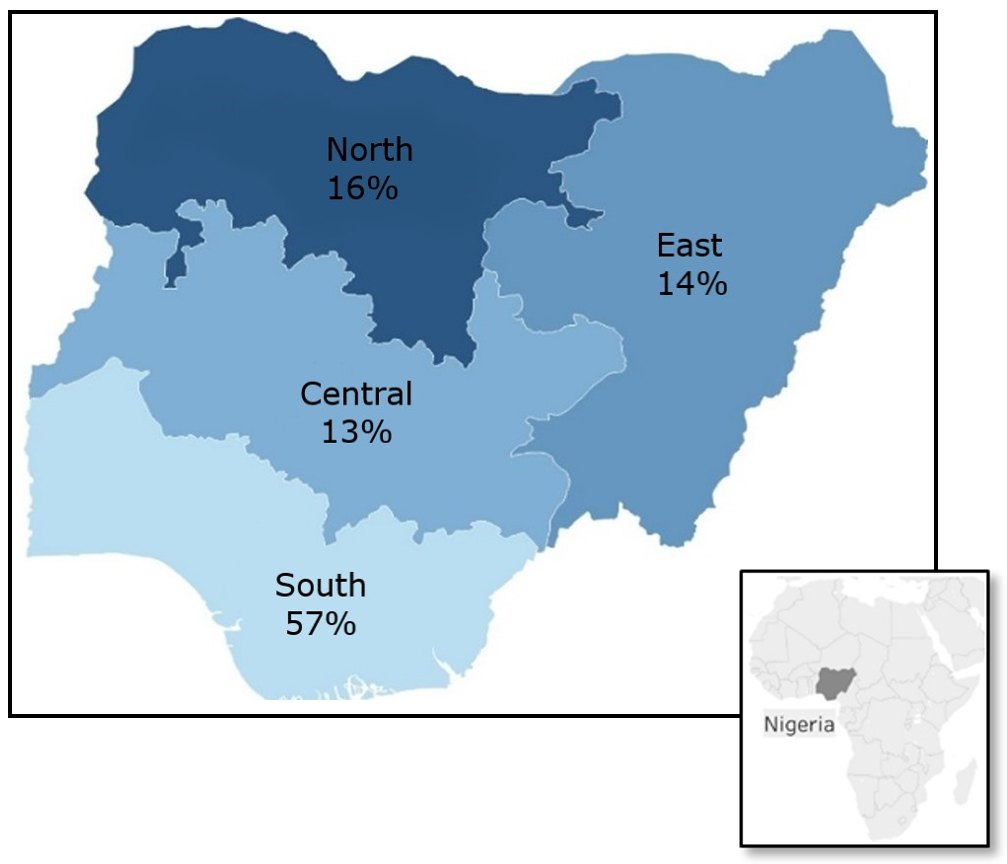

Total poultry population by agricultural zone (Data from 2016-17 livestock census).

- Nigeria has the largest annual egg production and second largest chicken population in Africa.

- The Nigerian poultry industry comprises about 180 M birds.

- Of these, 80 M chickens are raised in extensive systems, 60 M in semi-intensive, and the remaining 40 M in intensive systems.

- Poultry production in Nigeria amounts up to 300 Mt of meat and 650 Mt eggs per year.

- About 85 M Nigerians are involved in poultry production (many on a small to medium scale).

Poultry production systems

Extensive system

- The extensive/free-range/backyard system comprises nearly half of the chicken population.

- Flock sizes comprise up to 50 birds.

- Production is subsistence-oriented, mainly for family consumption with low levels of egg productivity.

- The flock includes birds of different indigenous species and varying ages.

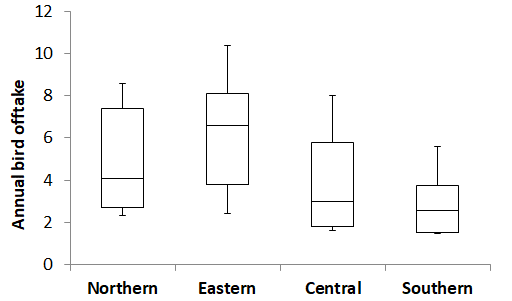

Median annual bird production rates (birds sold or consumed) range from 3 to 7 birds/year (box plots show 10th, 25th, 50th, 75th and 90th percentile) (Modelled in VIPOSIM using data from LSMS (2016)).

Semi-intensive system

- The semi-intensive system is a family-based subsistence and market-oriented production system, comprising about one third of total chicken population.

- The average flock size ranges from about 50 to about 2,000 birds including both improved and indigenous breeds with low to medium productivity

Intensive system

- The intensive poultry system is a market-oriented production with high bird numbers (> 2,000 birds) and high productivity levels from exotic breeds of poultry.

- Around 21% of chickens in Nigeria are raised in commercial/integrated farms.

- Most of these are concentrated in the south west region, near major cities.

Issues and opportunities for poultry

- The traditional indigenous poultry system is inexpensive and low input, with the capacity to handle harsh weather conditions and adapt to adverse environments.

- Rural poultry systems are generally of small-scale, characterised by insufficient hygiene management and receive little or no veterinary inputs.

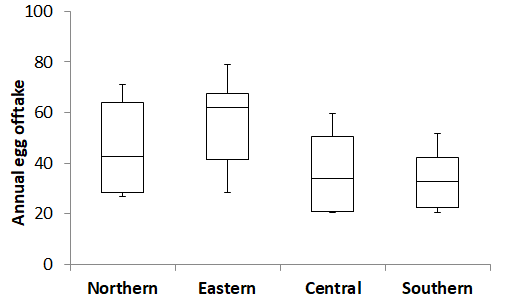

Median annual egg production rates (eggs/hen sold or consumed) range from 33 to 62 eggs/hen per year (box plots below show 10th, 25th, 50th, 75th and 90th percentile) (Modelled in VIPOSIM using data from LSMS (2016)).

- The costs of labour, medication, and fluctuating feed prices constitute substantial input costs in poultry production.

- Small-scale farmers suffer from marketing problems due to lack of market access with poor infrastructure.

- Indigenous birds are preferred by the majority of Nigerians for their taste, pigment, leanness and suitability for traditional dishes.

- Poultry production has not kept pace with the rapid increase in domestic consumption.

- There is enormous potential for the poultry industry in Nigeria to enhance food and nutritional security, while contributing to household and economic growth.

- Modelling can assist in understanding how interventions can improve egg and meat production for extensive backyard systems.

References:

- FAO 2019. The future of livestock in Nigeria. Opportunities and challenges in the face of uncertainty. FAO, Rome, Italy.

- Heise et.al. 2015. The poultry market in Nigeria: Market structures and potential for investment in the market. International Food and Agribusiness Management Review 18: 197-222.

- LSMS Survey.

- PAN 2017. History of the poultry association of Nigeria. Poultry Association of Nigeria, Abuja.

Download our poultry production in Nigeria fact sheet here.